Author: Zachary Moore

2021/02/19

HOUSTON (ICIS)–Widespread outages at crackers and polyethylene (PE) plants stemming from a major winter storm in Texas have exacerbated existing tightness in the US market.

Freezing temperatures, logistics disruptions and widespread power outages have caused a large number of plant outages, operating rate reductions and declarations of forces majeure or sales allocations.

The following table lists US PE units impacted by the winter storm in the US Gulf region:

| Producer | Location | Status |

| ExxonMobil | Beaumont, Texas | Site shutdown, sales allocation |

| ExxonMobil | Mont Belvieu, Texas | Site shutdown, sales allocation |

| LyondellBasell | Matagorda, Texas | Force majeure |

| LyondellBasell | Victoria, Texas | Force majeure |

| LyondellBasell | La Porte, Texas | Force majeure |

| LyondellBasell | Chocolate Bayou, Texas | Force majeure |

| Chevron Phillips | Cedar Bayou, Texas | Site shutdown |

| Chevron Phillips | Sweeny, Texas | Site shutdown |

| Chevron Phillips | Orange, Texas | Site shutdown |

| Chevron Phillips | Pasadena, Texas | Site shutdown |

| Formosa | Point Comfort, Texas | Site shutdown, force majeure |

| INEOS | La Porte, Texas | Force majeure |

| Dow | Orange, Texas | Site shutdown |

Combined, these units can produce 5.86m tonnes/year of linear low density polyethylene (LLDPE), 6.4m tonnes/year of high density polyethylene (HDPE) and 1.16m tonnes/year of low density polyethylene (LDPE), according to the ICIS Supply and Demand Database.

EXISTING TIGHTNESS EXACERBATED

These outages have exacerbated an existing state of supply tightness as the US PE market was already struggling to meet an increased demand pull from both local and overseas markets.

Industry operating rates and inventory levels declined between August and September 2020 as an active Atlantic hurricane season brought a number of plant disruptions.

The industry has struggled to rebuild inventories since then. Later in 2020, an unexpected shutdown at Braskem Idesa’s cracker and PE plant in Mexico siphoned off larger amounts of US product to that country. Sharply escalating freight rates and container shortages allowed US producers to increase their market share in some key export markets such as South America.

The scope and duration of the outages remain unknown and better estimates are likely next week as more crews get the opportunity to examine impacted plants. Some plants may be able to quickly return to service once pipes and other infrastructure thaw, while others may experience prolonged shutdowns if restoration crews discover additional damage.

“I expect this storm to affect supplies from our industry worse than Hurricane Harvey,” a trader said.

DOMESTIC DEMAND REMAINS STRONG

As supplies continue to tighten, domestic PE demand continues to remain strong.

Pandemic-induced changes in consumer behaviour, including an increase in at-home dining and the rising prevalence of online shopping, has been driving increased domestic consumption of PE packaging.

The recent economic recovery has been largely driven by increased demand for manufactured goods.. The manufacturing economy has been strong while the service economy continues to languish as much spending on travel and entertainment has been deferred.

SPOT EXPORT OFFERS ABSENT

In the wake of widespread production outages related to the storm, spot offers to the export market largely disappeared.

Spot availability had been limited prior to the storm impact, but markets became exceptionally quiet after the storm hit as producers, buyers and traders reassessed available volumes.

Traders commented that they have mostly been busy ensuring that previously placed orders will be delivered rather than making new offers, given the shortages of material.

Buyers in Latin America also report a shortage of offers for US product, with some saying that offers from Asia are also scarce as Asian and Middle Eastern producers are re-evaluating the global state of supply and demand balances following recent issues along the Gulf of Mexico.

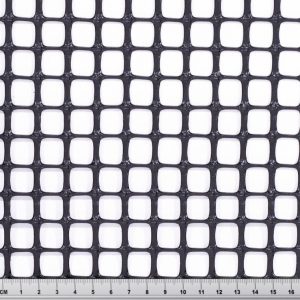

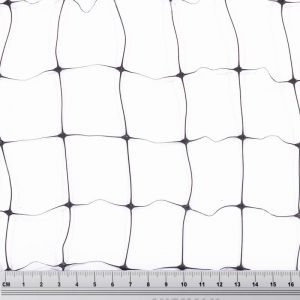

PE is the most widely used plastic in the world, primarily found in packaging including plastic bags, plastic films and geomembranes.

Major US producers of PE include Chevron Phillips Chemical (CP Chem), Dow, LyondellBasell, ExxonMobil, Formosa, INEOS, Total Petrochemicals and Westlake.